39 are zero coupon bonds taxable

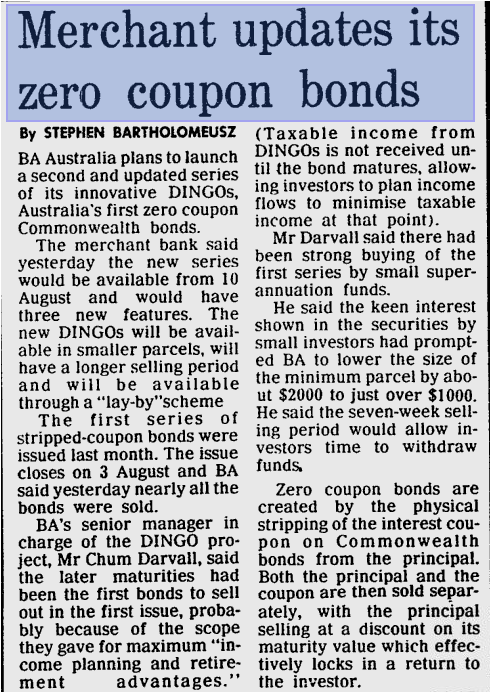

Publication 1212 (01/2022), Guide to Original Issue Discount ... The debt instrument is a stripped bond or coupon (including zero coupon bonds backed by U.S. Treasury securities). The debt instrument is a contingent payment or inflation-indexed debt instrument. See the discussions under Figuring OID on Long-Term Debt Instruments or Figuring OID on Stripped Bonds and Coupons , later, for the specific ... Business News, Personal Finance and Money News - ABC News Nov 10, 2022 · Find the latest business news on Wall Street, jobs and the economy, the housing market, personal finance and money investments and much more on ABC News

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Are zero coupon bonds taxable

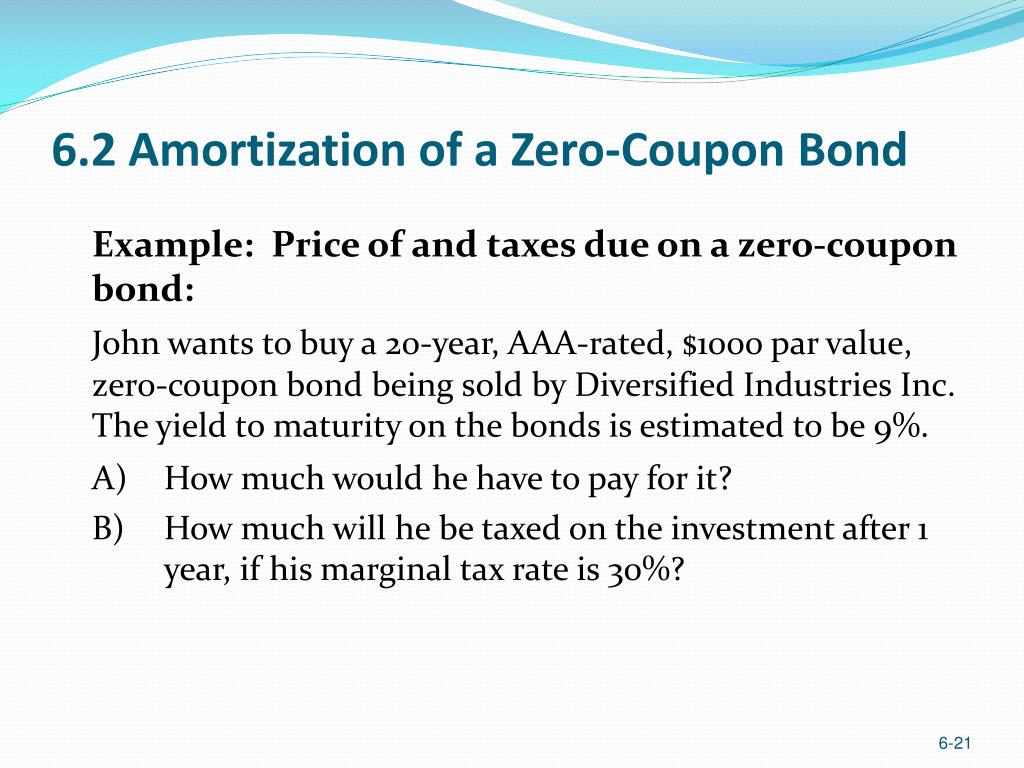

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Publication 550 (2021), Investment Income and Expenses ... All debt instruments that pay no interest before maturity are presumed to be issued at a discount. Zero coupon bonds are one example of these instruments. The OID accrual rules generally do not apply to short-term obligations (those with a fixed maturity date of 1 year or less from date of issue). See Discount on Short-Term Obligations, later. MSN MSN

Are zero coupon bonds taxable. Municipal Bonds - Fidelity Zero-coupon bonds Zero-coupon municipal bonds are issued at an original issue discount, with the full value, including accrued interest, paid at maturity. Interest income may be reportable annually, even though no annual payments are made. Market prices of zero-coupon bonds tend to be more volatile than bonds that pay interest regularly. MSN MSN Publication 550 (2021), Investment Income and Expenses ... All debt instruments that pay no interest before maturity are presumed to be issued at a discount. Zero coupon bonds are one example of these instruments. The OID accrual rules generally do not apply to short-term obligations (those with a fixed maturity date of 1 year or less from date of issue). See Discount on Short-Term Obligations, later. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Post a Comment for "39 are zero coupon bonds taxable"