38 zero coupon bond accrued interest

Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond. Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

Accrual Bond Definition - Investopedia An accrual bond defers periodic interest payments usually until maturity, much like a zero coupon bond, except the coupon rate is fixed to the principal value. Accrual bond interest is added to the...

Zero coupon bond accrued interest

How Premium Bonds are Priced | Zero Coupon Bond | Savings - PFhub A zero coupon bond does not make any interest payments throughout the life of the bond. There is only a single cash flow, at the time of maturity of the bond, when the par value of the bond is returned to the investors. ... Bond prices that include accrued interest are known as dirty bond prices while those excluding accrued interest are ... What Is a Zero-Coupon Bond? - The Motley Fool Say you want to purchase a bond with a face value of $10,000, 10 years to maturity, and 5% imputed interest. To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value.

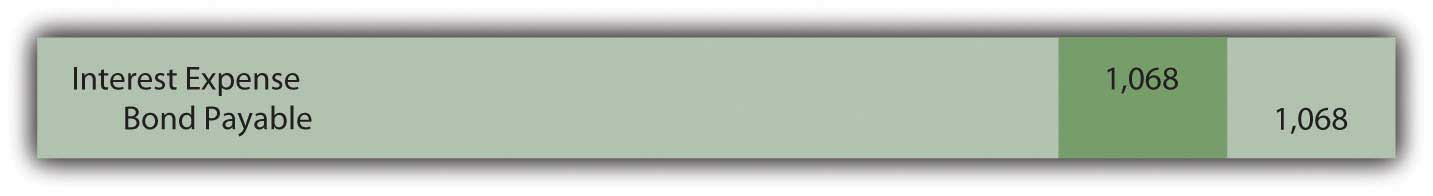

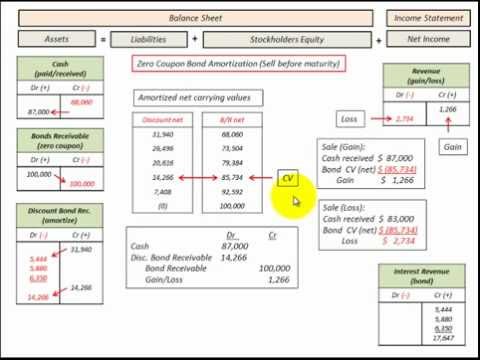

Zero coupon bond accrued interest. Zero Coupon Bond (Definition, Formula, Examples, Calculations) These Bonds are initially sold at a price below the par value at a significant discount, and that’s why the name Pure Discount Bonds referred to above is also used for this Bonds. Since there are no intermediate cash flows associated with such Bonds, these types of bondsTypes Of BondsBonds refer to the debt instruments issued by governments or corp... Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment. Accrued Interest and the Bond Market - Investopedia The amount of interest earned on a debt, such as a bond, but not yet collected, is called accrued interest . Interest accumulates from the date a loan is issued or when a bond's coupon is made. A... 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method

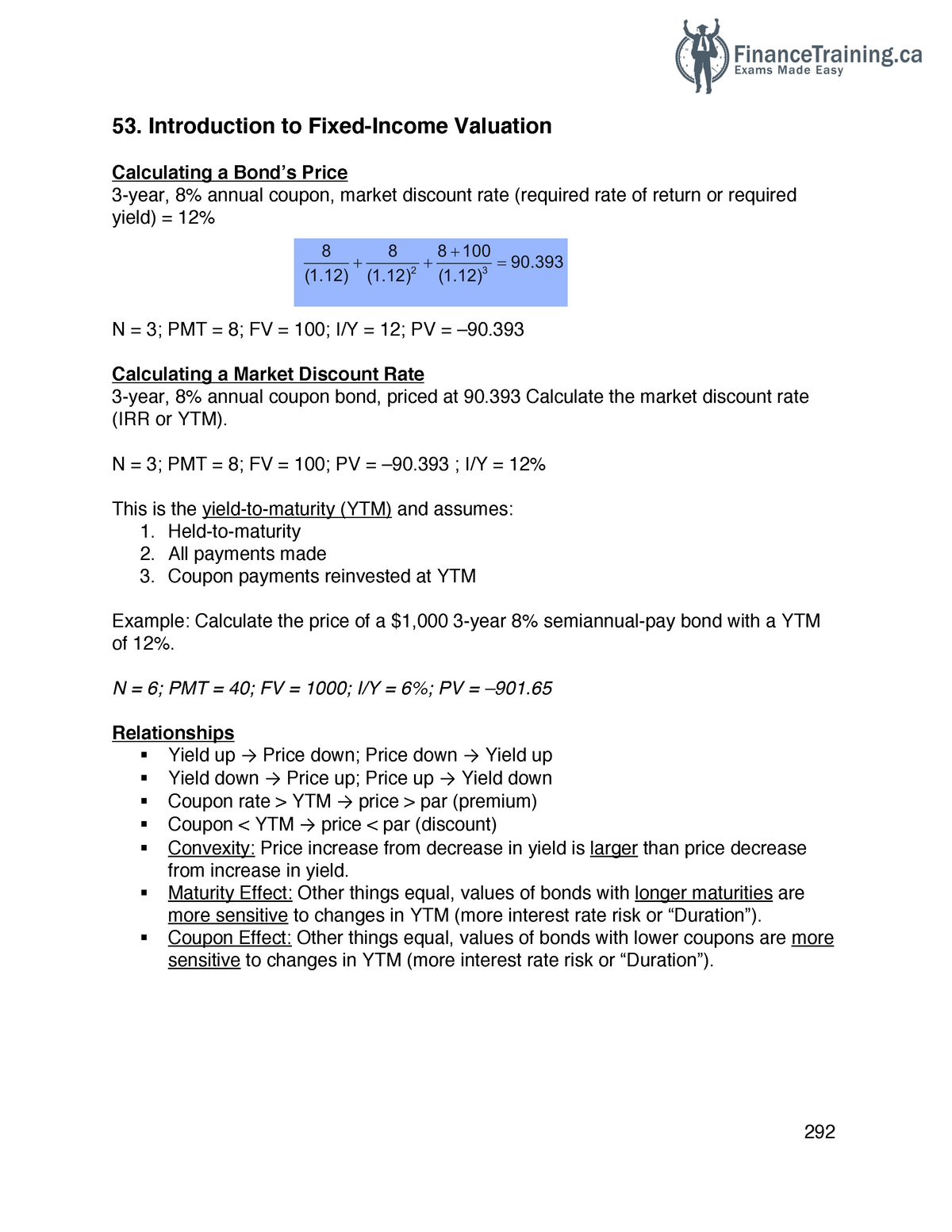

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator Let's say a $50,000 bond with a 5% coupon rate pays $2,500 in annual interest, irrespective of the bond's current price. However, if the interest rate increases to, say, 7%, the newly issued bonds with a $50,000 face value will pay an annual interest of $3,500. That means the 5% bond is hardly affected by the secondary market. Zero-Coupon Bond Definition - Investopedia May 31, 2022 · A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for... Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as. This formula will then become. By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top. Accrued Interest - Bond Dirty Price vs. Clean Price - GlynHolton.com It is the bond's accrued interest. Exhibit 2: A bond's market value (dirty price) can be disaggregated into a clean price and accrued interest. If we add the two graphs of Exhibit 2 together, we get the graph of Exhibit 1. We called the quantity depicted in Exhibit 1 the bond's market value, but another name for it is the bond's dirty price.

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ... Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Unlike other bonds or debentures, investment in zero coupon bonds does not give any periodic return. Therefore, annual interest cannot be taxed on accrual basis in this case like other bonds or debentures. Under Income Tax Act, gains on sale of any securities shall be taxable as long term or short-term capital gains depending on the holding period. Zero Coupon Bond Yield: Formula, Considerations, and Calculation Jul 15, 2022 · The IRS mandates a zero-coupon bondholder owes income tax that has accrued each year, even though the bondholder does not actually receive the cash until maturity. 1 This is called imputed interest... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Zero Coupon Municipal Bonds: Tax Treatment - TheStreet Using the earlier example, if you paid $500 for a 10-year, $1,000 bond getting an interest rate of 7.05%, you would accrue $35.25 of interest in the first year. $500 x 0.0705 = $35.25. Your ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If issued by a government entity, the interest generated by a zero-coupon bond is often exempt from federal income tax, and usually from state and local income taxes too. Various local...

Accrued Interest | What It Is and How It's Calculated - Annuity.org So, the formula to calculate accrued interest is: Face Value x (Coupon Rate ÷ 365) x Accrual Period That means an investor who sells a $100,000 bond with a 4 percent coupon 63 days after the bond's last payment date would receive $690.41 in accrued interest from the bond's buyer.

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than $100 in one year. By r...

Zero-Coupon Bond: Formula and Calculator [Excel Template] On the date of maturity – when the zero-coupon bond “comes due” – the bondholder is entitled to receive a lump-sum payment equal to the initial investment amount plus the accrued interest. Therefore, zero-coupon bonds consist of just two cash flows: Purchase Price: The bond’s market price on the date of purchase (cash inflow to bondholder)

How to Buy Zero Coupon Bonds | Finance - Zacks CDs. Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid ...

Bond Pricing and Accrued Interest, Illustrated with Examples Total Interest Paid by Zero Coupon Bond = Face Value - Discounted Issue Price 1 Day Interest = Total Interest / Number of Days in Bond's Term Accrued Interest = (Settlement Date - Issue Date) in Days × 1 Day Interest Zero Coupon Bond Price = Discounted Issue Price + Accrued Interest Bonds with Ex-Dividend Periods may have Negative Accrued Interest

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

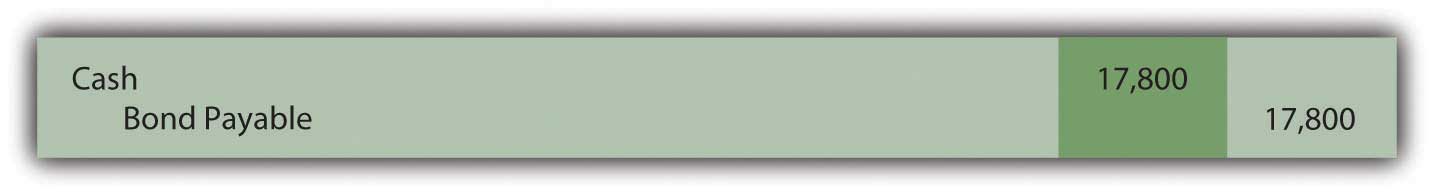

Accounting for Zero-Coupon Bonds - GitHub Pages Figure 14.10 December 31, Year Two—Interest on Zero-Coupon Bond at 6 Percent Rate. Note that the bond payable balance has now been raised to $20,000 as of the date of payment ($17,800 + $1,068 + $1,132). In addition, interest expense of $2,200 ($1,068 + $1,132) has been recognized over the two years.

Zero Coupon Bond Calculator - Nerd Counter Follow the simple steps below so you can use the coupon bond calculator: Usually, it is done in excel; for that, the procedure is given in detail. For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%.

Imputed Interest - Overview, Calculation, Tax Implications In filing tax returns, zero-coupon bonds are required to declare the imputed interest. The imputed interest for the year on zero-coupon bonds is estimated as the accrued interest rather than the minimum interest like in below-market loans. It is calculated as the yield to maturity (YTM) multiplied by the present value of the bond. The value of ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value.

What Is a Zero-Coupon Bond? - The Motley Fool Say you want to purchase a bond with a face value of $10,000, 10 years to maturity, and 5% imputed interest. To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon...

How Premium Bonds are Priced | Zero Coupon Bond | Savings - PFhub A zero coupon bond does not make any interest payments throughout the life of the bond. There is only a single cash flow, at the time of maturity of the bond, when the par value of the bond is returned to the investors. ... Bond prices that include accrued interest are known as dirty bond prices while those excluding accrued interest are ...

Post a Comment for "38 zero coupon bond accrued interest"