39 bond price zero coupon

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total … Pricing risk-based catastrophe bonds for earthquakes at an urban scale ... We price CAT bonds with a face value of €1 at time \(t=0\) years considering two types of payoff functions: zero-coupon and coupon. The coupon C is taken as €0.6.

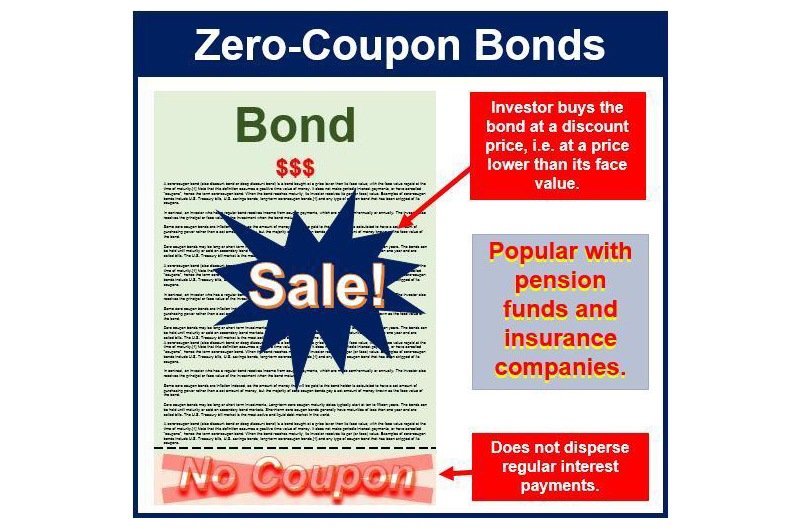

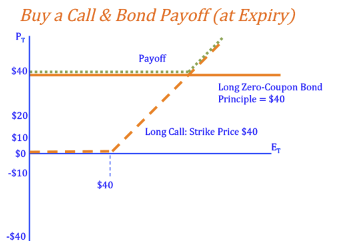

Zero-Coupon Convertible - Investopedia Due to the zero-coupon feature, the bond pays no interest and is therefore issued at a discount to par value, while the convertible feature means that bondholders have the option to convert bonds...

Bond price zero coupon

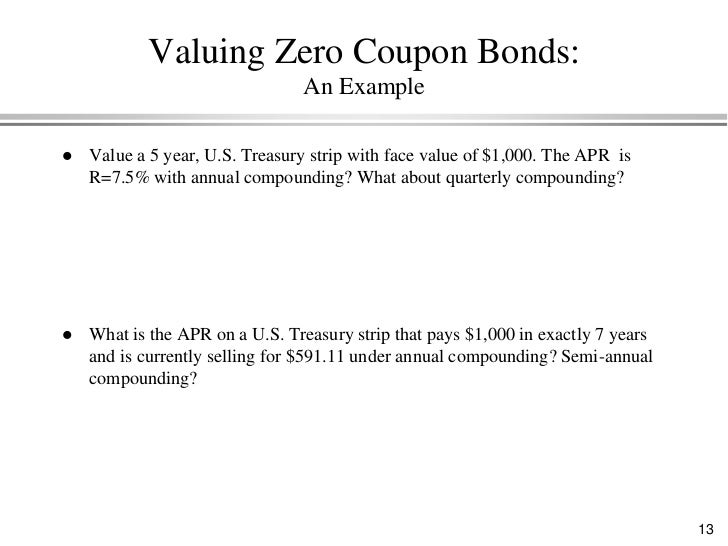

Understanding Zero Coupon Bonds - Part One - The Balance Here is an example of how zero coupon bond prices can change: For example, assume that three STRIPS are quoted in the market at a yield of 6.50%. The price for STRIPS with 25 years remaining to maturity would be $202.07 per $1,000 face amount That for STRIPS with 10 years remaining to maturity would be $527.47 per $1,000 face amount Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww There are two types of Zero Coupon Bonds, which are corporate Zero Coupon bonds and Government Zero Coupon bonds. How is the price of Zero Coupon Bond Calculated? The Zero Coupon Fund valuation can be done either on an annual or semi-annual basis. The annually Zero Coupon Bond and the semi-annual Zero Coupon Bond can be measured using two ... Advantages and Risks of Zero Coupon Treasury Bonds If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive...

Bond price zero coupon. › terms › zZero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Bond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas. Search for: Investing; Net Worth ... If it only pays out at maturity try the zero coupon bond calculator, although the tool can compute the market price too. Zero Coupon Bond - Price and Yield when interest rate is a diffusion ... The price of a Zero Coupon Bond and; The yield of a Zero Coupon Bond. I think that I have most of the calculations right, but I am missing a few pieces. My work goes as follows: What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula. A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. Zero Coupon Bond: Definition, Formula & Example - Study.com Invest in a reputable bond mutual fund that provides annual returns of 3%. You deem this to be an acceptable rate of return. Purchase a $10,000 Zero Coupon Bond from Company X that matures in 5... What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

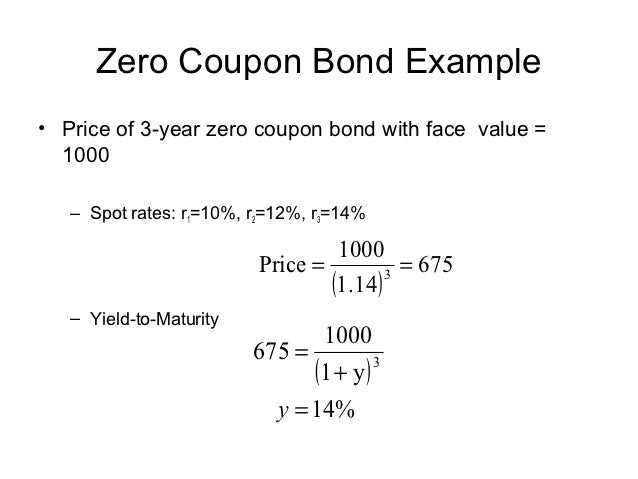

groww.in › p › zero-coupon-bondZero-Coupon Bonds : What is Zero Coupon Bond? - Groww There are two types of Zero Coupon Bonds, which are corporate Zero Coupon bonds and Government Zero Coupon bonds. How is the price of Zero Coupon Bond Calculated? The Zero Coupon Fund valuation can be done either on an annual or semi-annual basis. The annually Zero Coupon Bond and the semi-annual Zero Coupon Bond can be measured using two ... Zero Coupon Bond Calculator – What is the Market Price? The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. How to Calculate Bond Price in Excel (4 Simple Ways) Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Method 2: Calculating Bond Price Using Excel PV Function Zero Coupon Bond Yield: Formula, Considerations, and Calculation Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =...

Zero Coupon Bond Value - Formula (with Calculator) As shown in the formula, the value, and/or original price, of the zero coupon bond is discounted to present value. To find the zero coupon bond's value at its original price, the yield would be used in the formula. ... After the zero coupon bond is issued, the value may fluctuate as the current interest rates of the market may change. Example ...

Price of a Zero coupon bond - Calculator - Finance pointers Price of a Zero coupon bond - Calculator. August 20, 2021 | 0 Comment | 9:15 pm. The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below ...

What Is Dirty Price? - thebalance.com A zero-coupon bond is a bond that doesn't pay a coupon. Instead, it trades at a deep discount and pays investors a lump sum when the bond reaches maturity. Because there's no interest accruing for a zero-coupon bond, the clean price and dirty price are the same. Accrued interest is typically calculated after the transaction is completed.

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel; Calculate price of an annual coupon bond in Excel; Calculate price of a semi-annual coupon bond in Excel; Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get ...

What Are Corporate Bonds? What You Need To Know | GOBankingRates Some bonds, called zero-coupon bonds, do not pay interest during the term of the bond. They are purchased for prices below par, then the par value is paid when the bond matures. The investor's return is the difference between the purchase price paid for the bond and the par value. For example, a five-year zero-coupon bond with a par value of ...

What Is a Zero-Coupon Bond? | The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 =...

Post a Comment for "39 bond price zero coupon"