42 us treasury bonds coupon rate

US Treasury Series I Savings Bonds Inflation Rate Earnings ... U.S, Government Treasury is currently offering 7.12% Interest Rate in combined Fixed + Inflation Rate Earnings valid on newly issued Series I Savings Bonds purchased from November 2021 through April 2022. Limit of $10,000 / year in interest earnings per person. Thanks to community member dn90003 for sharing this offer. About this offer: 2 Year Treasury Rate - YCharts The 2 year treasury yield is included on the shorter end of the yield curve and is important when looking at the overall US economy. Historically, the 2 year treasury yield went as low as 0.16% in the low rate environment after the Great Recession. 2 Year Treasury Rate is at 2.47%, compared to 2.37% the previous market day and 0.16% last year.

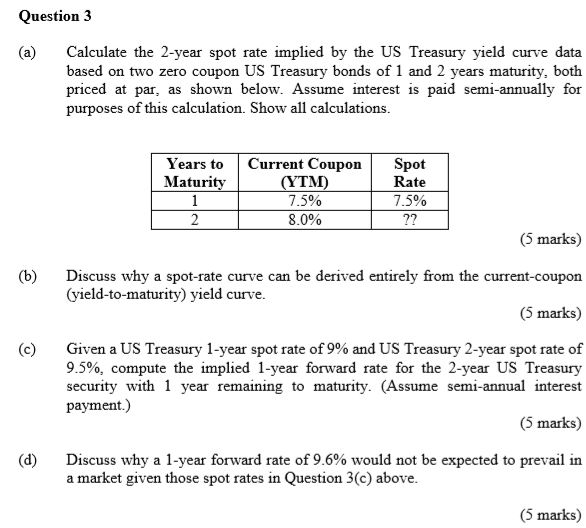

US Treasury Zero-Coupon Yield Curve US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,278 datasets) Refreshed 2 days ago, on 22 Apr 2022 Frequency daily Description These yield curves are...

Us treasury bonds coupon rate

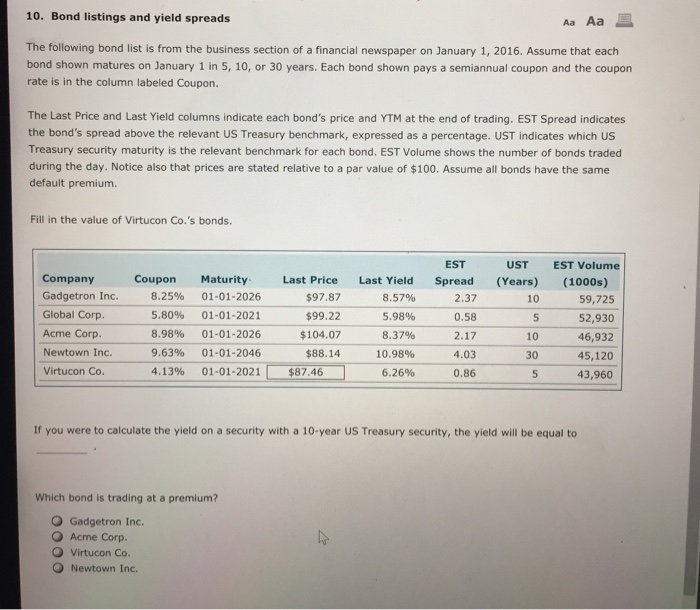

Bonds Vs Treasuries - Bonds Online In other words, a Treasury bond has a maturity range that spans ten years to thirty years, meaning Treasury bonds are the sovereign fixed-income securities with the most remarkable maturity spans. A Treasury note is a government-issued debt security that bears a fixed interest rate and has a one- to the ten-year maturity date. Important Differences Between Coupon and Yield to Maturity That means new Treasury bonds are being issued with yields of 4%. If an investor could choose between a 4% bond and a 2% bond, they would take the 4% bond every time. As a result, if you want to sell the bond with a 2% coupon, the basic laws of supply and demand force the price of the bond to fall to a level where it will attract buyers. Check out 30 year US treasury last price's stock ... - CNBC Yield Open 2.833% Yield Day High 2.86% Yield Day Low 2.829% Yield Prev Close 2.821% Price 87.9844 Price Change -0.5469 Price Change % -0.6211% Price Prev Close 88.5312 Price Day High 88.3906 Price...

Us treasury bonds coupon rate. Treasury Rates, Interest Rates, Yields - Barchart.com Treasury Rates. This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. Click on any Rate to view a detailed quote. Treasury bills, notes and bonds are sold by the U.S. Treasury Department. Beat Inflation With A Risk Free 7% U.S. Treasury Bond This compares to a one-year U.S. Treasury Bill paying 0.26% per year and the highest one-year CD on bankrate.com paying 0.67%. There are some "drawbacks" to Series I Bonds While 7.12% is a... Current Rates - Edward Jones 3.00%. $10,000,000 and over. 2.75%. Rates effective as of March 16, 2020 . The margin interest rate is variable and is established based on the higher of a base rate of 4.00% or the current prime rate. Our Personal Line of Credit is a margin loan and is available only on certain types of accounts. Treasury I-Bonds are Paying 7.12%! — Sapient Investments Treasury I-Bonds are Paying 7.12%! December 27, 2021 Inflation-Indexed Treasurys The U.S. Treasury offers two types of bonds that are indexed to inflation: 1) TIPS (Treasury Inflation-Protected Securities) and 2) Series I Bonds. They are different in many respects. TIPS pay a yield equal to the CPI plus or minus a certain percentage.

10-Year Treasury Note Definition - Investopedia When the Fed took emergency measures to cut rates by 50 basis points in early March, the decline of the 10-year yield accelerated even further, dipping below the psychologically important 1.00%... Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis. Check out US TREASURY-CURRENT 5 YEAR's stock price ... - CNBC 10-year Treasury yield retreats from 3-year high April 20, 2022 CNBC.com 10-year Treasury yield touches 2.94%, a level not seen since late 2018 April 19, 2022 CNBC.com U.S. Treasury Bonds, Bills and Notes: What They Are and ... Investors in longer-term Treasurys (notes, bonds and TIPS) receive a fixed rate of interest, called a coupon, every six months until maturity, upon which they receive the face value of the bond....

10 Year Treasury Rate - YCharts The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.903% yield. 10 Years vs 2 Years bond spread is 23 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.50% (last modification in March 2022). The United States credit rating is AA+, according to Standard & Poor's agency. How the Fed's rate increase may affect your bond portfolio If market interest rates rise to 4% in one year, the asset will still pay 3%, but the bond's value may drop to $925. The reason for the price dip is new bonds may be issued with the higher 4%... Advantages and Risks of Zero Coupon Treasury Bonds The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index...

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

US 10 year Treasury Bond, chart, prices - FT.com Bonds US 10 year Treasury US10YT US 10 year Treasury Yield2.90 Today's Change-0.002 / -0.05% 1 Year change+85.40% Data delayed at least 20 minutes, as of Apr 22 2022 22:05 BST. More Summary Charts...

Treasury Bond (T-Bond) Definition Treasury bonds are issued with maturities that can range from 20 to 30 years. They are issued with a minimum denomination of $100, and coupon payments on the bonds are paid semiannually.

20 Year Treasury Rate - YCharts The 20 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 20 years. The 20 year treasury yield is included on the longer end of the yield curve. The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an ...

The Commonwealth Government issues Treasury notes and Treasury bonds. Explain the difference ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

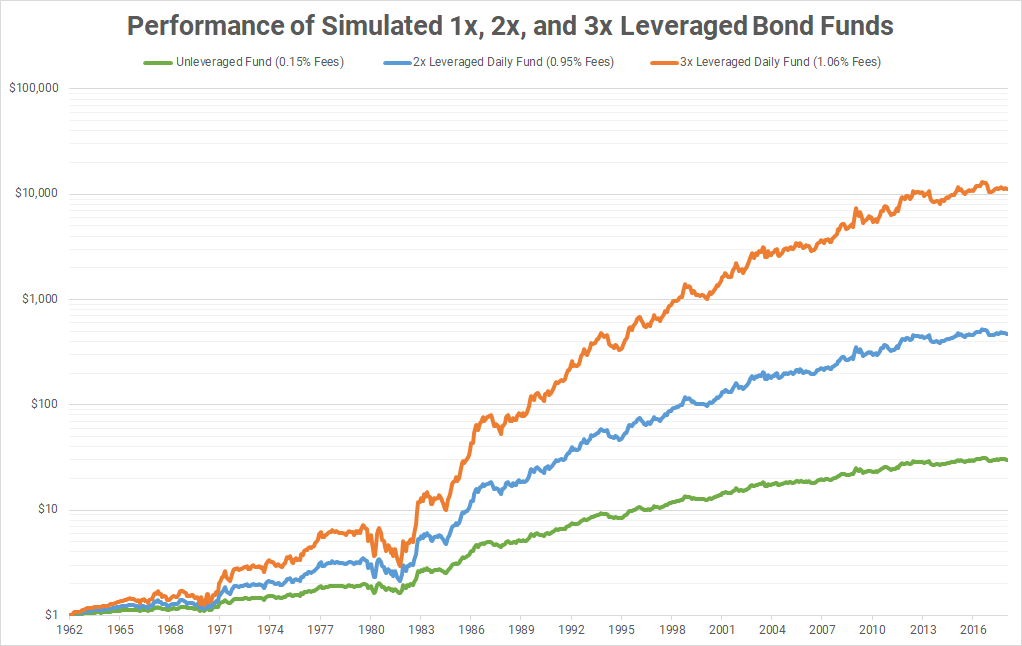

Simulated Performance Of Leveraged Bond Funds Since 1962 - Direxion Daily 30-Year Treasury Bull ...

Treasury Bonds vs. Treasury Notes vs. Treasury Bills: What ... Note Auction: A formal bidding process that is scheduled on a regular basis by the U.S. Treasury. Currently there are 17 authorized securities dealers (primary dealers) that are obligated to bid ...

A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity.

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10 ... Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-04-14 about 10-year, bonds, yield, interest rate, interest, rate, and USA.

US I bonds rates could soon yield 9.6%, but how long can ... Next month, the Treasury Department will reset the rate for its I Bonds. Since their rate is tied to the government inflation index which just came in at 8.5%, analysts say I Bonds are likely to ...

Treasury Inflation-Protected Securities: FAQs about TIPS ... The annual coupon payment equals the fixed coupon rate multiplied the adjusted principal value. Note that the initial TIPS principal value is $1,000 and TIPS coupon payments are actually paid on a semiannual basis, not an annual basis like this example illustrates. Example is hypothetical, for illustrative purposes only. 3.

US Treasury Now Offering 7.12% Interest Rate on Series I ... If you have at least $25 to invest and you're open to the idea of buying savings bonds, the U.S. Department of the Treasury is currently paying a 7.12% annual rate on Series I Bonds purchased now through April of 2022. A Series I Bond is a nearly risk-free inflation-protected investment, making it an option worth considering for anyone trying ...

Check out 30 year US treasury last price's stock ... - CNBC Yield Open 2.833% Yield Day High 2.86% Yield Day Low 2.829% Yield Prev Close 2.821% Price 87.9844 Price Change -0.5469 Price Change % -0.6211% Price Prev Close 88.5312 Price Day High 88.3906 Price...

Important Differences Between Coupon and Yield to Maturity That means new Treasury bonds are being issued with yields of 4%. If an investor could choose between a 4% bond and a 2% bond, they would take the 4% bond every time. As a result, if you want to sell the bond with a 2% coupon, the basic laws of supply and demand force the price of the bond to fall to a level where it will attract buyers.

Bonds Vs Treasuries - Bonds Online In other words, a Treasury bond has a maturity range that spans ten years to thirty years, meaning Treasury bonds are the sovereign fixed-income securities with the most remarkable maturity spans. A Treasury note is a government-issued debt security that bears a fixed interest rate and has a one- to the ten-year maturity date.

Post a Comment for "42 us treasury bonds coupon rate"